Our Maryland estate planning lawyer compiled these frequently asked questions about estate planning. If you would like to set up a free consultation with our Maryland trust attorney, please call us now.

What is estate planning?

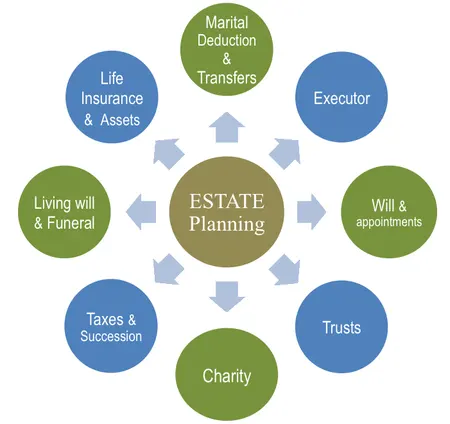

Your estate is made up of your real and personal property, insurance proceeds, investments, and other tangible and intangible property. Estate planning involves the development of a strategy for the preservation of property during life and the distribution of property after death. If you fail to create your own estate plan, the state will create one for you. Adams Law Office, LLC is a suburban Maryland and Washington, DC metropolitan law firm assisting clients with the development of a plan for the distribution of their property after death through individualized advice and preparation of applicable documents, such as wills, trusts, powers of attorney, and advance healthcare directives.

Why have a will?

Without a will, state laws of “intestate succession” kick in. *In MD, the following distributions would apply if you died without a will:

If survived by spouse and parents:

– ½ of estate, plus $15,000 to spouse

– Balance to parents

If survived by spouse and children:

– ½ of estate to spouse; ½ to children

If survived by spouse and adult children:

– ½ of estate, plus $15,000 to spouse

– ½ of estate to children (not including step- children)

If no living heirs or step-children:

– Estate goes to the Board of Education

If the intestate laws do not precisely reflect your wishes, a will and/or a revocable living trust is necessary.

*See MD Code Ann., Estates and Trusts §§ 3–101 et seq. (2003) for a complete description of intestate distributions.

What are the benefits of a will?

What is a revocable living trust?

A revocable living trust (“RLT”) is a separate entity created for holding title to property for the benefit of a beneficiary. A revocable living trust is just that – revocable and changeable by the person who created it. With an RLT, you, the property owner are the Settlor, who creates and can amend the trust, the original Trustee, who manages and distributes the property held in trust, and the beneficiary until death, at which time, a Successor Trustee transfers the property to the successor beneficiaries. Control over the property remains with the owner(s) during life and the transfer of property after death occurs without probate. If you have property in more than one state, a trust can eliminate the need for probate proceedings in multiple jurisdictions. Also, if your estate, including life insurance, is sizable and over the estate tax exemption amount ($11.58 million as of 2020), a revocable living trust for you and your spouse can save your beneficiaries tens of thousands in estate taxes. In addition, a trust can allow for great specificity with regard to distributions for beneficiaries, asset protection, retirement plan distribution planning to limit income taxes, provisions for special needs children, blended family planning, and provisions to prevent guardianship.

What is probate and should it be avoided?

Probate is the process by which a court supervises the distribution of probate property according to a verified will or the laws of intestate succession. Probate property generally includes assets owned individually. The primary reasons for avoiding probate involve the costs and time associated with the process. In Maryland and DC, for small estates, the actual court costs and probate fees involved are nominal and the probate process is more streamlined than in the past. For many estates, a valid will and individualized planning can minimize the impact of the probate process. However, estate plans effectively utilizing a trust can avoid probate altogether and allow for distribution of assets without court involvement or delay, keep the estate plan private, minimize and/or delay estate taxes for estates with assets (including life insurance) over the estate tax exemption, provide for assets to be held in trust and distributed over a period of time, and can allow for the management of assets if necessary due to incapacity.

Call today for a consultation with one of our caring and experienced Attorneys!

4201 Northview Drive, Suite 401 • Bowie, MD 20716 Serving the Maryland and DC areas

Office Hours

Copyright © 2023 Adams Law Office, LLC All Rights Reserved

DISCLAIMER: No information you obtain from this website or its content is legal advice, nor is it intended to be. You should consult an attorney for individualized advice regarding your own situation. No attorney-client relationship is intended or formed by your viewing this website or downloading and using the content, forms, tips or information kits found on this website. No attorney-client relationship is intended or formed without a fully-executed, written agreement to enter into such a relationship. Client testimonials or endorsements do not constitute a guarantee, warranty, or prediction regarding the outcome of your legal matter.