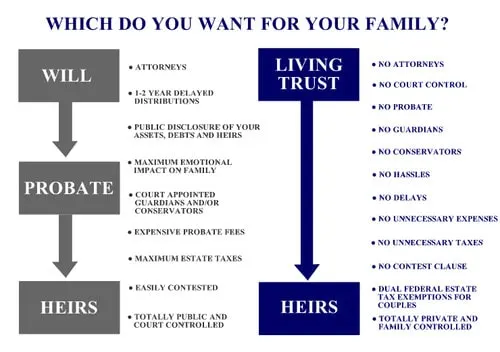

An introduction to living trusts — a popular way to avoid probate.

What’s Below:

Our Maryland estate planning attorney compiled these frequently asked questions about estate planning and living trusts. If you would like to set up a free consultation with our Maryland trust attorney, please call us now.

Call today for a consultation with one of our caring and experienced Attorneys!

4201 Northview Drive, Suite 401 • Bowie, MD 20716 Serving the Maryland and DC areas

Office Hours

Copyright © 2023 Adams Law Office, LLC All Rights Reserved

DISCLAIMER: No information you obtain from this website or its content is legal advice, nor is it intended to be. You should consult an attorney for individualized advice regarding your own situation. No attorney-client relationship is intended or formed by your viewing this website or downloading and using the content, forms, tips or information kits found on this website. No attorney-client relationship is intended or formed without a fully-executed, written agreement to enter into such a relationship. Client testimonials or endorsements do not constitute a guarantee, warranty, or prediction regarding the outcome of your legal matter.